We offer professional advice in the fields of financial strategy and capital markets issues.

We customize our advice in a very confidential way and it focused to company owners, founders

and management teams.

BLAETTCHEN FINANCIAL ADVISORY was founded in summer

2010. Prior our Team worked together at the advisory company Blaettchen & Partner AG for many

years. Therefore we have an unique capital market advisory experience in IPOs, bond issues and

implementation of management equity programs with more than 50 transactions and several billions

EUR issue volume over three decades.

Our Company is completely owned by its

active partners and is not a part of a financial institution. Hence, we are fully independent

and not exposed to any conflicts of interest.

We appreciate the high level of trust our clients have in us.

Managing Director and Partner

Managing Director and Partner

Managing Director and Partner

Team assistant

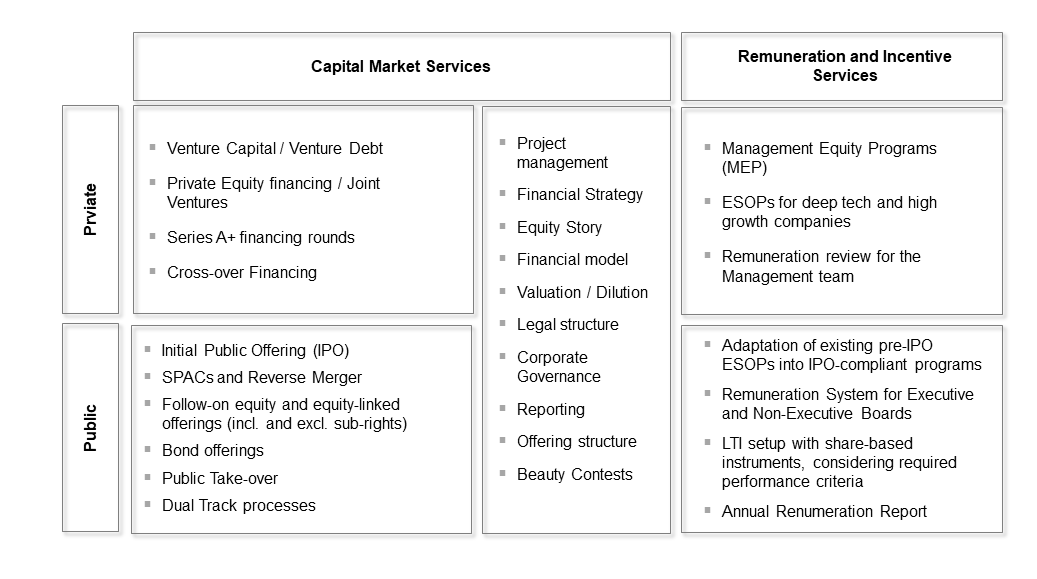

We support clients (companies and manager) as independent advisor on all issues of equity offering or other equity-related transactions:

- Initial Public Offerings

- Private Equity Financing

- Mezzanine

- Warrants and convertibles

- Follow on Equity Offerings (new shares, existing shares, with and without subscription rights)

The intention to go public is in general a once in a lifetime highlight for the issuer, the companies´

owners and the founders and has to be prepared and supported carefully.

Our core competences

are focused on the development of individual capital market strategies for different financing instruments.

This process starts from the initial decision to go public, embraces all necessary steps to achieve the

IPO readiness, leads to the selection of suitable project partners ("beauty contest") and includes the

whole project management. We manage the upcoming conflicts of interest between company owners, financial

sponsors, underwriters and the involved advisors.

We support our clients to structure and manage

a "dual track transaction", that means a complex process in which the shareholders pursue an IPO and a trade

sale option simultaneously. IPOs on international Exchanges such as NASDAQ, whether in the form of a direct

listing or in the form of a "reverse" merger with a "SPAC" (Special Purpose Acquisition Company), are familiar to us.

We assist companies in the offering of non listed equity financing

instruments such as mezzanine, Pre-IPO private equity finance, warrants and convertibles.

Furthermore we are the sounding board for the stock exchanges concerning design and implementation of new

capital market services for issuers and investors.

References:

We support our clients to design and implement a "management equity program" (MEP) in a typical LBO transaction.

The participants of this program have usually potential to invest a significant amount. Therefore, a balanced

risk profile and fair conditions for the MEP are essential to reach the long-term goals. The upcoming conflicts

of interest between the involved parties will be moderated and managed by us.

We also help to develop

a "state of the art" equity participation and incentive program for employees and managers ("Employee Stock

Option Plans" or ESOP) before or after an IPO. Particularly fast-growing Biotech- and Deep-Tech companies have strong empathies

to share the future value creation in an early stage of the company lifetime. Such designed incentive program

must be open for the future "exit event" and may not hinder it. This applies in particular to the IPO. Hence,

we support clients to restructure existing equity participations programs in a recapitalization situation.

We also support our clients in developing and implementing a remuneration system for their Top Management and Supervisory Advisory Board. Listed companies are required to establish a remuneration system for their governing bodies, which must be approved by the Annual General Meeting. The basis for the preparation is a comprehensive analysis of national and international peer companies, the definition of appropriate performance targets for the variable remuneration components and the selection of share-based instruments for long-term incentives. As an annual remuneration report must be published, we provide support in its preparation and review the existing remuneration system on an ongoing basis to ensure that it is appropriate and up-to-date.

References:

We are proud to support the mayor German stock exchanges to design and to implement the innovative market places

for listed corporate bonds. We were nominated bondm-FOUNDATION-COACH at the Boerse Stuttgart and are DEUTSCHE

BOERSE CAPITAL MARKET PARTNER at the Frankfurt Stock Exchange.

In the first step we support you to find

the fundamental decision to issue a capital market instrument as a corporate bond or alternative instruments

(notes, private placements).

Our key point of analysis is the capital market capability of our clients,

which will be necessary for a bond issue.

As independent advisor we assist our clients to issue a corporate

bond. The issue concept can include an "issuer controlled offering" in consideration of several distribution channels.

The alternative concept can be a "bank controlled" issue, where the mandated investment bank underwrites and sells

the bond by means of a syndicate. We support the client to develop the suitable issue concept, select the professional

partners (banks, selling agents) via a "beauty contest" and bring the issuer together with potential investors and

intermediaries and negotiate the optimal conditions.

Furthermore we assist our clients to execute a "dual

track process", in which both a bond issue and alternative refinancing options (credit facility, notes etc.) are

simultaneously followed.

References:

We are DEUTSCHE BOERSE CAPITAL MARKET PARTNER in following fields of activities and segments:

- IPO- and Corporate Finance Advice

- Scale for shares

- Scale for corporate bonds

- Prime Standard for corporate bonds

05/2025

BLÄTTCHEN FINANCIAL ADVISORY advised the IPO of PFISTERER Holding SE on the basis of an agreement with the main shareholder Mr Karl-Heinz Pfisterer. PFISTERER is a globally operating company that develops, produces and distributes products for connecting and insulating electrical conductors at power grid interfaces. In 2024, it generated sales of € 383 million. The initial listing took place on 14 May 2025 in the Scale segment of the Frankfurt Stock Exchange as the first IPO of the year in Germany. The market capitalisation at the issue price was € 489 million. The company received gross proceeds of around € 95 million from the placement volume of approximately € 188 million. These proceeds are to be used primarily to finance growth. The first price of the PFISTERER share was set at € 30.00, the issue price was € 27.00. (Info)

12/2022

BLAETTCHEN FINANCIAL ADVISORY supported the Management Team of CUSTOMCELLS Holding GmbH in the preparation and execution of their financing round (Series A) in the amount of €60 million. The climate-tech venture capitalist World Fund and the Hamburg-based family office Abacon were capital lead investors in this financing round. The existing investor Vsquared Ventures and Porsche AG also participated in the Series A as existing investors. CUSTOMCELLS is one of the world's leading companies in the development of special lithium-ion battery cells. CUSTOMCELLS intends to invest the proceeds to expand its activities in the electrification of air traffic, intensify its research and development activities and accelerate its internationalization. (Link to the press release)

03/2022

BLAETTCHEN FINANCIAL ADVISORY assisted BioNTech's Management Team in structuring a Share Repurchase Program of up to $1.5 billion over the next two years. The repurchased ADSs are to be used in whole or in part to satisfy upcoming settlement obligations under BioNTech's share-based compensation agreements.

07/2021

BLÄTTCHEN FINANCIAL ADVISORY advises the Executive Committee of AC Immune S.A., a NASDAQ-listed Swiss biotechnology company (based in Lausanne), on its strategic acquisition of a clinically-validated active vaccine candidate for the treatment of Parkinson's disease from Affiris AG, a Austrian biotechnology company (based in Vienna). The transaction has a total volume of approximately USD 85 million, consisting of a contribution in kind of about USD 59 million (including a USD 5 million cash contribution) and a USD 25 million private placement cash capital increase (PIPE). The cash contribution of USD 5 million together with the PIPE will be provided by Affiris' major shareholders Athos Service GmbH (a Family Office of the Strüngmann brothers), MIG Fonds and First Capital Partner GmbH (a Family Office of Mr. Wolfgang Egger). (Link to the press release)

07/2021

BLAETTCHEN FINANCIAL ADVISORY supports the Deutsche Aktieninstitut (DAI) in the preparation of their survey "Listing abroad of BioNTech, CureVac & Co. - Recommendations to policy makers for more IPOs in Germany" published on July 14, 2021 (PDF in German)

11/2020

BLAETTCHEN FINANCIAL ADVISORY supported the management of BIONTECH SE in the structuring of an "At The Market" program in the amount of USD 500 million. An ATM program enables the Company to issue incremental shares close to the market. BioNTech is the first German company listed on the NASDAQ in the legal form of an SE to launch such a program.

10/2020

17. Mittelstandsforums Baden-Württemberg am 20. Oktober 2020 in Stuttgart (Programm)

09/2020

JENNEWEIN Biotechnologie had announced its IPO in the beginning of 2020. In this context a number of investors indicated their interest in taking over the company. Therefore, the shareholders decided to enter into a structured M&A process in parallel to the the ongoing IPO preparations with the intention to divest (Dual Track). Finally, the shareholders agreed to sell to CHR. HANSEN on September 22nd, 2020 for € 310m.

BLÄTTCHEN FINANCIAL ADVISORY supported JENNEWEIN´s Management in preparing the IPO Track.

JENNEWEIN Biotechnologie is an industrial Biotechnology company. It has developed and patent-protected innovative processes for the industrial production of Human Milk Oligosaccharides (HMOs) and launched the HMOs in the infant formula and medical nutrition markets.

07 - 08/2020

BLAETTCHEN FINANCIAL ADVISORY supported the management of BIONTECH SE in its public offering of 5.5 million new American Depositary Shares ("ADSs") as well as further 0.83 million ADS as granted over-allotment option from a selling shareholder. These ADSs were placed in an Accelerated Bookbuilding process ("ABB Offering") at USD 93 per ADS in the period from 21 July 2020 to 22 July 2020. All ADSs could be placed with new and existing investors after the waiver of approximately 75% of subscription rights of BioNTech's key shareholders. The Company has received a gross proceeds of USD 511.5 million. The total "ABB Offering" volume amounts USD 588.2 million including the over-allotment option.

Following to the "ABB Offering" BioNTech's shareholders, who did not waive their subscription rights, were offered additional up to 1.9 million new ordinary shares resp. ADSs at USD 93 per ordinary share resp. ADS. The subscription ratio was 31:1 (31 ordinary share rights will entitle a holder of such rights to purchase one new ordinary share). This "Rights Offering" comprised an effective issue volume of up to USD 176 million. The subscription period started on July 28, 2020 and ended on August 14, 2020.

07/2020

BLAETTCHEN FINANCIAL ADVISORY supported the management of IMMATICS Biotechnologies GmbH as financial advisor in the successful completion of the merger with ARYA Sciences Acquisition Corp., a NASDAQ-listed special purpose acquisition company (SPAC). After completion of the "Business Combination" the shares of the newly founded IMMATICS N.V. are listed on NASADQ since July 02, 2020. The transaction has an equity value of over 600 million USD. IMMATICS is a clinical biopharmaceutical company developing T-cell based cancer immunotherapies, with its operational headquarters in Tübingen.

06/2020

BLAETTCHEN FINANCIAL ADVISORY supported the management of BIONTECH SE in structuring a four-year mandatory convertible note in the amount of USD 112 million, which was granted to Temasek, a Singapore-based investment company, as part of a private placement. In addition to the mandatory convertible, a further approximately USD 139 million of new shares were placed with Temasek and other accredited investors.

03/2020

BLAETTCHEN FINANCIAL ADVISORY supported the management board of BIONTECH SE in an equity investment agreement with Shanghai Fosun Pharmaceutical (Group) Co., Ltd. Under the terms of the agreement, Fosun Pharma has agreed to make an equity investment of USD 50 million for 1,580,777 ordinary shares in BioNTech. This equity investment agreement is a part of a strategic development and commercialization collaboration to advance BioNTech's mRNA vaccine candidate BNT162 in China for the prevention of COVID-19 infections.

02/2020

BLAETTCHEN FINANCIAL ADVISORY supported the management board of BIONTECH SE in its role as financial advisor to close the public takeover with NEON Therapeutics, Inc. (Nasdaq: NTGN). BioNTech will acquire Neon in an all-stock transaction valued at approximately USD 67 million. Neon is a biotechnology company developing novel neoantigen- based T cell therapies.

10/2019

BLAETTCHEN FINANCIAL ADVISORY supported as financial advisor the initial public offering of the BIONTECH SE with a total issue volume (incl. underwriters over-allotment) of $173 m and a market capitalization of $3.4bn on the NASDAQ Global Select Market. The Company offered in total 11.5 Mio. American Depositary Shares ("ADSs"), with each ADS representing one ordinary share. BIONTECH belongs to the worldwide leading biotechnology companies in the development of individualized mRNA-based product candidates, innovative chimeric antigen receptor T cells, novel checkpoint immunomodulators, targeted cancer antibodies and small molecules.

25.07.2019

DER BÖRSENGANG - VIEL MEHR ALS EINE FINANZIERUNGSALTERNATIVE FÜR DEN MITTELSTAND!

03/2019

07/2018

01/2018

BLAETTCHEN FINANCIAL ADVISORY supported BIONTECH AG to design and to implement a capital market relatet Employee Participation Program and supported the management board in this context to prepare an Pre-IPO Financing Round (Series A) in a volume of 270 Mio USD.

11/2017

WM WORKSHOP - IPOs Initial Public Offerings, 2017 November 09 in Munich (siehe Flyer)

09/2017

RSW Vortragsreihe University Hohenheim, 2017 September 06. in Stuttgart (see Flyer)

03/2017

BLÄTTCHENFINANCIAL ADVISORY supported CARL ZEISS MEDITEC AG to complete its capital increase without subscripiton rights (up to 10% of its share capital) in a total proceeds of approx. 317 m€ (see Flyer)

01/2017

BLAETTCHEN FINANCIAL ADVISORY supported MOLOGEN AG to complete its convertible bond placement as part of a prospectus-exempt public rights offering in a total volume of about 5.0 m€

11/2106

WP Board Academy "Rechte und Pflichten des Aufsichtsrats", 2016, November 29. in Frankfurt (see Flyer)

10/2016

BLAETTCHEN FINANCIAL ADVISORY supported MOLOGEN AG to complete its capital increase with subscription rights and a follow-up convertible bond issue in a total volume of 16,1 m€

07/2016

Finance Technology Transactions, July 21. in Munic (see Flyer)

03/2016

Germany M&A and Private Equity Forum 2016, March 16. and 17. in Düsseldorf (see Flyer)

02/2016

BLAETTCHEN FINANCIAL ADVISORY supported the IPO of the B.R.A.I.N. AG with a total issue volume (incl. over-allotments) of 32.5 m Euro in the Prime Standard of the Frankfurt Stock Exchange. B.R.A.I.N. AG is one of Euorpe's leading technology companies in the field of indsutrial or "white" biotechnology, the core discipline of the bioeconomy and is the first listed German issuer in this sector at the Frankfurt Stock Exchange

11/2015

WM-WORKSHOP - IPOs und IBOs - November 2015 in Munich (see Flyer)

05/2015

BLAETTCHEN FINANCIAL ADVISORY supported SeniVita Social Estate AG to issue a Going Public convertible note in a volume of up to 50 Mio. € listed in the Quotation Board (Open Market) of the Frankfurt Stock Exchange

11/2014

WM-WORKSHOP - IPOs and IBOs - 12 November 2014 in Munich (see Flyer)

10/2014

BLAETTCHEN FINANCIAL ADVISORY supported PNE WIND AG to complete its combined capital increase with subscription rights and a convertible bond issue in a total volume of 40,0 m€

07/2014

BLAETTCHEN FIANCIAL ADVISORY has advised PAION AG – a listed (Prime Standard / FSE) biotech company – to complete its capital increase with subscription rights in a volume of 46,3 m€

05/2014

BLAETTCHEN FINANCIAL ADVISORY supported SeniVita Sozial gGmbH to issue a participatory notes in a volume of up to 25 Mio. € listed in the Quotation Board (Open Market) of the Frankfurt Stock Exchange

02/2014

Workshop "Immobilien- und Projektanleihen als Finanzierungsmöglichkeit" on 27 February 2014 in Berlin (see Flyer)

01/2014

BLAETTCHEN FIANCIAL ADVISORY has advised PAION AG on its capital increase with subscription rights

11/2013

M&A Forum Stuttgart "Unternehmensfinanzierung im Kontext von M&A-Transaktionen" on 21 November 2013 in Stuttgart (see Flyer)

11/2013

Workshop "MBO und MBI - Vom Manager zum Unternehmer" on 06 November 2013 in Frankfurt/Main (see Flyer)

09/2013

BLAETTCHEN FINANCIAL ADVISORY supported PNE WIND AG to issue a second tranche of its 8.0% corporate bond 2013/2018 (WKN: A1R074) in a volume of 33.7 Mio. € within a private placement. With the reached total bond volume of 100.0 m€ the bonds are to be included in the Prime Standard segment for company bonds on September 19, 2013.

09/2013

Workshop "Immobilien- und Projektanleihen" on 30 September 2013 in Stuttgart (see Flyer

03/2013

Workshop "Finanzierung über den Kapitalmarkt" on 24 September 2013 in Stuttgart (see Flyer)

07/2013

BLAETTCHEN FINANCIAL ADVISORY GmbH supported Cloud No. 7 GmbH to issue a senior secured bond of up to € 35 Mio. at bondm of the boerse stuttgart

05/2013

BLAETTCHEN FINANCIAL ADVISORY supported PNE WIND AG to issue a senior bond of up to € 100 Mio. in the regulated market of the DEUTSCHE BOERSE AG and the intended admission in the Prime Standard for Corporate Bonds

06/2011

BLAETTCHEN FINANCIAL ADVISORY GmbH was appointed as DEUTSCHE BOERSE LISTING PARTNER

05/2011

BLAETTCHEN FINANCIAL ADVISORY GmbH supported ALBERT REIFF GMBH & CO. KG to issue a senior bond of up to € 30 Mio. at bondm of the boerse stuttgart

12/2010

BLAETTCHEN FINANCIAL ADVISORY supported RENA GmbH to issue a senior bond of up to € 75 Mio. at bondm of the boerse stuttgart

11/2011

BLAETTCHEN FINANCIAL ADVISORY GmbH was appointed as BONDM-FOUNDING-COACH of boerse stuttgart

01/2025

2024 _____________________________________________________________________________________________________________________

06/2024

01/20242023 _____________________________________________________________________________________________________________________

05/2023

03/2023 01/20232022 _____________________________________________________________________________________________________________________

06/2022

"Börse als Basis für Mitarbeiterbeteiligung" erschienen in FuS "Familienunternehmen und Strategie" (in German only)

04/2022 01/2022 2021 _____________________________________________________________________________________________________________________ 12/2021 08/2021 04/2021 VentureCapital Magazin 3-2021 Börsengang via SPAC? 01/2021 2020 _____________________________________________________________________________________________________________________ 12/2020 VentureCapital Magazin 8-2020 Blättchen Financial Advisory 12/2020 FUS-6-2020 Alternative Wege an den US-Kapitalmarkt für deutsche Familienunternehmen 12/2020 FUS-6-2020 "Im Bereich Biotechnologie ist der US-Markt offener und mutiger" Interview mit H. Jeggle 03/2020 Das Neuemissionsjahr 2019 (in German) 02/2020 VentureCapital Magazin 1-2020 Blättchen Financial Advisory (in German) 01/2020 Capital market review 2019 (in German) 2019 _____________________________________________________________________________________________________________________ 01/2019 Capital market review 2018 (in German) 2018 _____________________________________________________________________________________________________________________ 09/2018 Renaissance des Kapitalmarkts in FuS 04/2018 (in German) 05/2018 GP Special GP Kapitalmarktrecht 2018_Der Börsengang ist wieder eine Alternative (in German) 03/2018 Capital market review 2017 (in German) 2017 _____________________________________________________________________________________________________________________ 06/2017 Wer finanziert den digitalen Umbruch? - in FuS 03/23017 (in German) 04/2017 20 Jahre Neuer Markt: Verdrängtes Trauma oder vernachlässigte Chancen? (in German) - VentureCapital Magazin 05/2017 04/2017 Auf der Suche nach neuen Wegen - in Unternehmer-Edition, April 2017 (in German) 04/2017 Neuer Markt: 20 Jahre danach - im Going Public Magazin 04/2017 (in German) 01/2017 Capital market review 2016 (in German) 2016 _____________________________________________________________________________________________________________________ 11/2016 Teil II: Sind die Ratings der Mittelstandsanleihen aussagefähig? Kredit & Rating Praxis 5/2016 10/2016 "Es muss möglich sein, Technologie-Startups zu Industrieunternehmen zu entwickeln" (in German) -Interview Dr. Holger Zinke in der Fus 05/2016 09/2016 Teil I: Sind die Ratings der Mittelstandsanleihen aussagefähig? Kredit & Rating Praxis 4/2016 06/2016 Der Börsengang der BRAIN AG - FUS I 03/2016 04/2016 BRAIN-IPO bindet die Retail-Anleger ein - Qurtalsmagazin BRAIN AG 2. Q 2016 04/2016 Die Produktpipiline muss lukrative Märkte mit Blockbuster-Potenzial adressieren - VentureCapital Magazin 04/2016 03/2016 Corporate Bond Markt 2015 - in BondGuide-Special "Anleihen 2016" (in German) 02/2016 Brain-IPO bindet die Retail-Anleger ein - published in Börsenzeitung 09.02.2016 (in German) 01/2016 Capital market review 2015 (in German) 2015 _____________________________________________________________________________________________________________________ 10/2015 Kapitalmarktfinanzierung und Familienunternehmen - in FuS 5/2015 06/2015 Börsenkapital für Wachstumsunternehmen: eine Langfristbetrachtung, Venture Capital Magazin 07/2015 04/2015 IPO lernen - Corporate Finance & Praivte Equity Guide, Going Public 02/2015 Der Corporate Bond Martk 2014 - BondGuide-Special "Anleihen 2015" 01/2015 Capital market review 2014 (in German) 2014 _____________________________________________________________________________________________________________________ 11/2014 "Die Wandelanleihe verbindet zwei Welten" in Going Public 12/2014 08/2014 "Aktuelle Entwicklungen in der Kapitalmarktfinanzierung von Familienunternehmen" from Prof. Dr. Wolfgang Blättchen / Uwe Nespethal in Familienunternehmen und Stiftung (FuS) 04/2014 07/2014 "Der deutsche IPO Markt kann sich aus seiner Lethargie befreien" in Börsen-Zeitung Special 06/2014 Der Genussschein - ein börsentaugliches Finanzierungsinstrument 04/2014 Blockierter Zugang - Mittelstandsfinanzierung 2014 04/2014 Best Practice Guide: Entry Standard für Unternehmensanleihen - Deutsche Börse Cash Market 03/2014 Standards for Bondcommunication - DVFA 03/2014 03/2014 Kapitalmarkt-Sentiment 2014 - Expertinterview in GoingPublic Magazin 02/2014 "Der Corporate-Bond-Markt 2013 - Unterschiedliche Entwicklungen in den Segmenten" (in German) from Uwe Nespethal / Prof. Dr. Wolfgang Blättchen in BondGuide Special "Anleihen 2014" 01/2014 Capital market review 2013 (in German) "Neue Facetten der Kapitalmarktfinanzierung für Familienunternehmen" from Prof. Dr. Wolfgang Blättchen / Uwe Nespethal in Familienunternehmen und Stiftung 05/2013 2013 _____________________________________________________________________________________________________________________ 05/2013 "IPO UND IBO: EIN GOING PUBLIC HAT UNTERSCHIEDLICHE FACETTEN BEKOMMEN" from Prof. Dr. Wolfgang Blättchen / Uwe Nespethal in Going Public Special "Kapitalmarktrecht 2013" 03/2013 "DER MANAGER IM VERKAUFSPROZESS" from Prof. Dr. Wolfgang Blättchen / Dr. Stephan Mahn in Boardreport 01/2013 03/2013 "WICHTIGER PFEILER DER FINANZIERUNG - DER COPORATE BOND MARKT - EIN ÜBERBLICK" from Prof. Dr. Wolfgang Blättchen / Uwe Nespethal in Going Public Special "Anleihen 2013" 2012 _____________________________________________________________________________________________________________________ 08/2012 from Prof. Dr. Wolfgang Blättchen / Uwe Nespethal in Familienunternehmen und Stiftung (FuS) 04/2012 02/2012 "HOME RUN - DIE POTENZIELLE ZIELGRUPPE FÜR DEN PRIME STANDARD FÜR UNTERNEHMENSANLEIHEN" from Uwe Nespethal / Prof. Dr. Wolfgang Blättchen in Going Public Special "Anleihen 2012" 02/2012 "EINE ANLEIHE IST MITUNTER SOGAR EIN MUSS FÜR EIN BUY-OUT" Interview with Prof. Dr. Wolfgang Blättchen and Alexander von Preysing in Going Public Special "Anleihen 2012" 2011 _____________________________________________________________________________________________________________________ 11/2011 "MITTELSTANDSANLEIHE - RICHTIG EINGESETZT" from Prof. Dr. Wolfgang Blättchen / Uwe Nespethal in informer release 11-2011 10/2011 "AKTUELLE PROBLEME UND LÖSUNGSANSÄTZE BE DER FINANZIERUNG VON FAMILIENUNTERNEHMEN" from Prof. Dr. Wolfgang Blättchen / Uwe Nespethal in Familienunternehmen und Stiftungen (FuS) 03/2011 07/2011 "DIE IDEE DER MITTELSTANDSANLEIHE WIRD ERWACHSEN!" from Prof. Dr. Wolfgang Blättchen in BondGuide - Der Newsletter für Unternehmensanleihen Ausgabe 5, KW 28/29 2011 05/2011 "UNTERNEHMENSANLEIHEN ALS ATTRAKTIVES MITTELSTAND-FINANZIERUNGSINSTRUMENT" from Prof. Dr. Wolfgang Blättchen and Dr. Stephan Mahn in Börsen-Zeitung 03/2011 "NEUER ZUGANG ZUM KAPITALMARKT - 2010 WAR DAS JAHR DER BÖRSENNOTIERTEN MITTELSTANDSANLEIHEN" from Prof. Dr. Wolfgang Blättchen in Corporate Finance & Private 28 Equity Guide 2011 02/2011 "INTERESSANTE KAPITALMARKTALTERNATIVE" from Prof. Dr. Wolfgang Blättchen / Uwe Nespethal published in Going Public Magazin Special "Anleihen 2011" März 2011 2010 _____________________________________________________________________________________________________________________ 12/2010 "ANLEIHEEMISSION MITTELSTÄNDISCHER UNTERNEHMEN" from Prof. Dr. Wolfgang Blättchen / Uwe Nespethal in Corporate Finance 8/10 11/2010 from Prof. Dr. Wolfgang Blättchen in Deutschen Aktieninstitut Finanzplatz 11/2010 "DIE RAHMENBEDINGUNGEN AUSSERHALB DER BÖRSENVERFASSUNG SIND SCHWIERIGER" Sentiment surveys under IPO-Experts in Venture Capital Magazin 11/10 09/2010 "BOND-EIGENEMISSIONEN SIND MÖGLICH" from Prof. Dr. Wolfgang Blättchen in Börsen-Zeitung 08/2010 BONDM - "MISSING LINK" FÜR MITTELSTÄNDISCHE ANLEIHEEMITTENTEN from Prof. Dr. Wolfgang Blättchen in Going Public Magazin 07/10 07/2010 KOLUMNE - "EINE LÜCKE, DIE ES ZU SCHLIESSEN GILT" from Prof. Dr. Wolfgang Blättchen / Uwe Nepethal in Going Public Magazin 6/10

2023 - 2024 Kolumnensammlung (in German)

2021 - 2022 Kolumnensammlung (in German)

2020 Kolumnensammlung (in German)

2018-2019 Kolumnensammlung (in German)

2017 Kolumnensammlung (in German)

2016 Kolumnensammlung (in German)

2015 Kolumnensammlung (in German)

BLAETTCHEN FINANCIAL ADVISORY GmbH

Roemerstrasse 75

71229 Leonberg

BOX: 1338 - 71203 Leonberg - Germany

MAIL: info(at)blaettchen-fa.de

FON: +49 (0) 7152 6101940

The protection of your personal data is of major importance to the operator of this website. We shall treat your personally

identifiable data confidentially and in keeping with legal data privacy regulations and the present Data Privacy Statement.

As a rule, the use of our website does not require your disclosing any personally identifiable data. To the extent it is

necessary to enter any personally identifiable date on our website (e.g. name, postal address or e-mail address) such

compilation will, when possible, be on a voluntary basis. The data so compiled will not be transmitted to any third party

without your express consent.

We should like to note that Internet-based data transmission (e.g. e-mail communication)

may be susceptible to security gaps. It is thus not possible to ensure end-to-end data protection against third-party access.

Some of our Internet pages use so-called cookies. Cookies do not damage your computer in any way and do not contain any

viruses. Cookies have for their purpose to render our offer more user-friendly, more effective and securer. Cookies are

small text files placed on your computer and stored by your browser.

Most of the cookies we use are so-called 'session cookies', meaning that they will be deleted automatically after your visit

to our website. Other cookies remain stored on your end device until you delete them. With such cookies we are able to recognise

your browser once you re-visit our website.

You can modify your browser preferences such that you are informed promptly before a cookie is stored on your end device

to allow storage of cookies in individual cases only, accept cookies in specific cases, or permanently block cookies, and

automatically delete cookies once you close your browser. However, deactivating cookies on your end device may restrict

your use of the functionalities of our website.

The provider of this website automatically compiles and stores information in so-called server log files your

browser automatically sends to us. Such information includes:

Our website uses Google Maps to depict maps and generate driving directions. Google Maps is operated by Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, USA. When visiting our website, Google collects the information about your viewing relevant pages on our website. Such data is also collected whether or not you have a user account with Google or are logged in to your Google user account. In the event you are logged in to your Google user account and visit our website, collected data will be allocated to your Google user account directly. Should you not wish such data collection, you are advised to log out of your Google account prior to visiting our website. By using Google Maps, you agree to Google's or, as the case may be, any third party's compiling, processing, and using the data automatically collected and entered by you. For Google Maps' terms of use, please refer to Google Maps' Terms of Service. You may also find detailed information at google.com: Transparency and Choice as well as Privacy Policy. You are required to assert your right of objection directly vis-à-vis Google. You may deactivate the Google Maps service directly via your browser's settings (deactivation of JavaScript in your browser). Using Google Maps will then no longer be possible.

For reasons of security and protection of transmission of confidential content, such as requests you send to us as website operator, our website

uses SSL encryption. You may recognise encrypted connections whenever the address bar of your browser changes from "http://" to "https://"

and your browser line depicts a lock icon.

Once SSL encryption is activated, data you send us cannot be read by third parties.

DWe herewith object to using our contact details required to be disclosed within the framework of our web imprint for sending us advertising e-mails and information not expressly solicited. The operators of this website expressly reserve the right to take legal action in case of unsolicited sending of advertising information, such as spam.

Finally, on May 18th 2022, we were able to make up for our 10th anniversary planned for 2020.

At this occasion, in the presence of the Ambassador Inga Skujina and a Latvian delegation, we were able to celebrate the appointment of our partner Wolfgang Blättchen as Honorary Consul of the Republic of Latvia in Baden-Württemberg.

We celebrated in the hall "Spange des Kunstmuseums Stuttgart" (Museum of the Year 2021) and combined this with a guided tour through the exhibition of the sculptor Tobias Rehberger, which shows central groups of works of the well-known artist over the last three decades.

After the long pandemic period we were pleased to welcome so many of our long-time companions in person once again.

It was an enjoyable evening with the positive side effect, that we were able to donate a considerable amount to Rotary Hilfe Leonberg-Weil der Stadt.